Total household debt stocks increased by $16 billion in the second quarter of 2023, according to the latest Quarterly report on household debt and credit From the Federal Reserve Bank of New York Microeconomic Data Center. This reflects a modest uptick from the first quarter. Credit card balances saw the largest increase of all types of debt – $45 billion – and now stand at $1.03 trillion, surpassing $1 trillion in nominal terms for the first time in the chain’s history. After a sharp contraction in the first year of the pandemic, credit card balances have seen seven-quarters of the year-over-year growth. The second quarter of 2023 saw a rapid increase of 16.2 percent over the previous year, continuing this strong trend. As credit card balances rise to historic highs, we look at how lending and repayment will evolve using the Federal Reserve Bank of New York Consumer Credit Panel (CCP), which is based on anonymized Equifax credit report data.

Credit card issuance

Credit cards are the most prevalent form of household debt and continue to be more prevalent. Keep in mind that there are 70 million more credit card accounts open now than there were in 2019, before the pandemic. Moreover, about 69 percent of Americans had a credit card account in the second quarter of 2023, up from 65 percent in December of 2019 and just 59 percent in December of 2013. And while lending declined during the first year of Pandemic, credit card issuances have been fairly high since then.

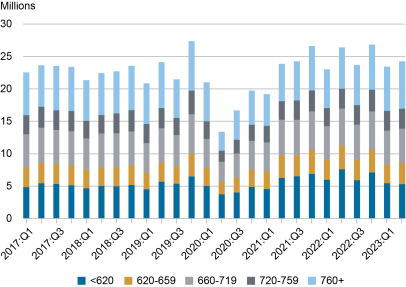

In the chart below, we depict opening new credit card accounts, broken down by borrowers’ credit scores. Credit card issuance has been fairly flat overall, with an average of about 23 million credit card issuances per quarter between 2017-2019. The onset of the pandemic caused a sharp decline in the issuance of new credit cards, with just 13 million cards issued in the second quarter of 2020. But by the second quarter of 2021, lending had returned across all credit rating groups.

Subprime borrowers saw card issuance rise in 2021 and 2022, although this appears to have abated in the first half of 2023. In contrast, card issuance expanded to borrowers with the highest credit scores – those with more than 760 – during the first half of 2023. This relative tightening is consistent with other reports: July 2023 Senior Loan Bureau opinion survey on bank lending practices (SLOOS) Tightening Standards for All Consumer Loan Standards, June 2023 SCE credit access survey It showed an increase in credit application rejection rates, especially among those with low credit scores.

Issuance of credit card according to credit points

Credit card delay

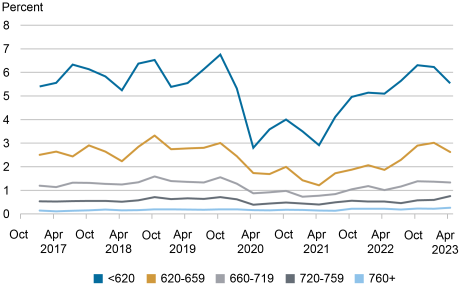

In February we wrote about the increase in default rates and our plan to continue to monitor the situation. Delinquency rates are now back to pre-pandemic levels. In the chart below, we rank conversions to default by the borrower’s credit score at issue. This picture is consistent with a return to pre-COVID trends after a period of extraordinarily low default rates during the pandemic when forbearance, an income boost, and consumption opportunities were limited, meaning borrowers were in a better position to repay their debts. The last two quarters seem to be showing some stability. Note that these rates differ from the transition rate calculated in Quarterly report Because they are not formatted and use more detailed data.

The level of late payment rates has been discontinued

Move into a payment delay of 30 days or more

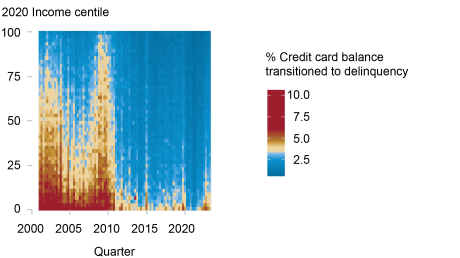

Finally, we consider debt performance by income to determine whether aggregate statistics may mask the economic challenges inherent in low-income communities. We aggregate borrowers using their Zip Code-Adjusted Average Gross Income as a proxy for income, using data from the IRS (Zip Code Income). In the heatmap pattern diagram below, we depict credit card delinquency aggregated by zip code income, shown on the y-axis, with the delinquency percentage indicated by color. Here, we first see that lower-income areas have historically had higher delinquency rates, while higher-income areas typically have better debt performance. But before the Great Financial Crisis, credit card delinquencies were more prevalent, even in high-income areas, and even increased between 2008 and 2010. But now, after a brief period of extraordinarily low delinquencies between 2020-22, they have returned. Late payment rates are back to normal at pre-pandemic levels even in low-income areas.

Delayed credit card by zip income

Despite the many headwinds American consumers have faced over the past year — rising interest rates, post-pandemic inflation pressures, recent bank failures — there is little evidence of widespread financial distress for consumers. American consumers have so far weathered the economic hardships of the pandemic and post-pandemic periods. However, growing balances may pose challenges for some borrowers, and resuming student loan payments this fall could add additional financial stress for many student borrowers. So far, however, household credit is showing some early signs of stabilizing into pre-pandemic health, albeit with higher nominal balances.

Andrew F Huggott He is the interim director of research and chair of the Research and Statistics Group at the Federal Reserve Bank of New York.

Donghun Lee Economic Research Consultant in Consumer Behavior Studies in the Research and Statistics Group of the Federal Reserve Bank of New York.

Daniel Mangrum He is a Research Economist in Equitable Growth Studies in the Research and Statistics Group of the Federal Reserve Bank of New York.

Joel Scully He is the regional economic director in the Research and Statistics Group of the Federal Reserve Bank of New York.

Wilbert van der Klawe Economic Research Consultant for Family and Public Policy Research in the Research and Statistics Group of the Federal Reserve Bank of New York.

How to cite this post:

Andrew Huot, Donghoon Lee, Daniel Mangrum, Joel Scully, and Wilbert van der Klawe, “Credit Card Markets Returning to Normal Post-Pandemic Halt,” Federal Reserve Bank of New York Liberty Street Economics8 Aug. 2023, https://libertystreeteconomics.newyorkfed.org/2023/08/credit-card-markets-head-back-to-normal-after-pandemic-pause/.

Disclaimer

The opinions expressed in this publication are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”