Investors around the world have issued a skeptical judgment about Xi Jinping’s third term in office, selling shares in Chinese companies after the country’s leader concluded a Communist Party congress that signaled a shift in focus from economics to security.

The sell-off began Monday morning in Asia, with Hong Kong’s Hang Seng Tech shedding 9.7 percent, a one-day move that matched its biggest drop ever. It continued into the US trading day, during which many of the most famous Chinese technology groups listed on Wall Street fell sharply.

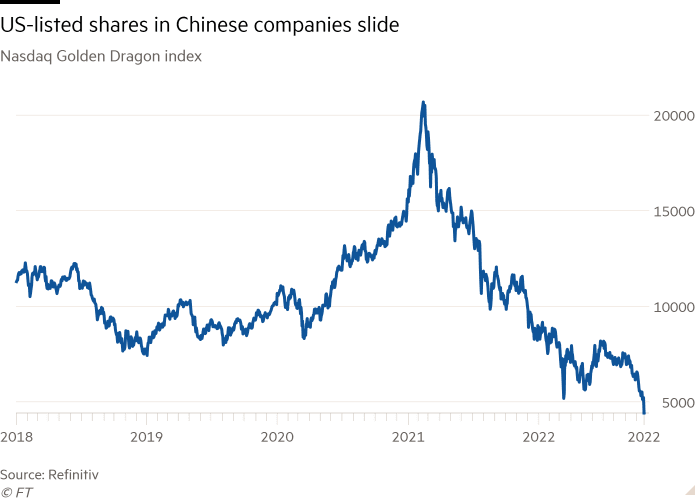

Nasdaq’s Golden Dragon, which tracks US-listed stocks of Chinese companies, fell 14.4 percent as Alibaba, JD.com and Pinduoduo faced heavy selling. The index’s record one-day decline has sent it down nearly 50 percent this year.

Analysts said the sell-off was exacerbated by Beijing’s release of economic data, delay During the congress of the Party, it showed the growth of China’s economy 3.9 percent year-over-year In the third quarter, it fell short of the government’s annual target of 5.5 percent.

But they also noted that Xi’s reform of the party leadership during the week-long 20th Party Congress, which ended at the weekend, gave power to loyalists more interested in the geopolitical rivalry between China and the United States than economic reform.

“The danger is more about groupthink, ideation, and the line about the dire need for conflict with the United States,” said Gerard Debebeau, a former chief China economic analyst at the CIA. “It makes sense from a market perspective, that whatever hope you have of a liberal turn in China, it’s likely to be lower now than it was on Friday.”

In the months leading up to the party congress, Xi showed a growing disregard for economic reform, imposing strict Covid-19 lockdowns despite its impact on the Chinese economy. He also launched a regulatory crackdown on some of the country’s fastest growing technology groups.

“President Xi clearly wanted a team to carry out his vision,” said one US industry executive.

Frank Benzemra, head of Asian equity strategy at Société Générale, said investors are concerned about the shift in the party’s top leadership body announced Sunday, which has been stacked with cadres more focused on national security than economic reform.

“While Chinese policy has long been opaque, this sharp consolidation of power is adding to investor anxiety,” said Mark Heffel, chief investment officer for global wealth management at UBS. “Stock valuations, which are already near 10-year lows, are likely to face further pressure if international investors demand a higher risk premium.”

Among the biggest names to suffer from the sell-off, Alibaba, which closed down 12.5 percent in Wall Street trading, sending its shares below the $68 offering price they went public in New York eight years ago, in what was At the time the largest list in the world.

The company has increased its revenue by more than 14 times and doubled its adjusted earnings in the years since it first appeared on the market. But stocks have been falling since 2020 after Beijing canceled the IPO of Ant Group’s digital payments company, which was set to raise a record $37 billion.

Alibaba’s 80 percent decline in that period reflects a loss of about $670 billion in stock market value. The technology company reported in August The first decline in quarterly revenue Since its inclusion in New York.

Monday’s jolt highlighted the growing challenges facing China’s largest tech groups since Xi .’s launch organizational repression in the sector.

One Alibaba employee said the government’s crackdown on technology and a falling share price worried “leadership and energy”.

“For the past year or two, people have stopped working hard,” the person said, noting that they personally worked about 20 hours less per week.

Alibaba filings also show that the company has shed more than 13,000 positions since the beginning of the year.

Additional reporting by Nian Liu in Beijing, Patrick Mathurin in London and Eric Platt in New York

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”