He was Another tough day to Power delivery (NASDAQ: Delivery) on Wednesday as the market turned south and investors sold riskier assets and energy stocks. Shares were down 13.5% and were down 13.2% at 3:30 PM ET.

The conductive force disintegrates

Delivery capacity has fallen by 84% in the past year, and there is no end in sight to this decline. Not only are losses piling up, but money is also dwindling and there is no bailout expected.

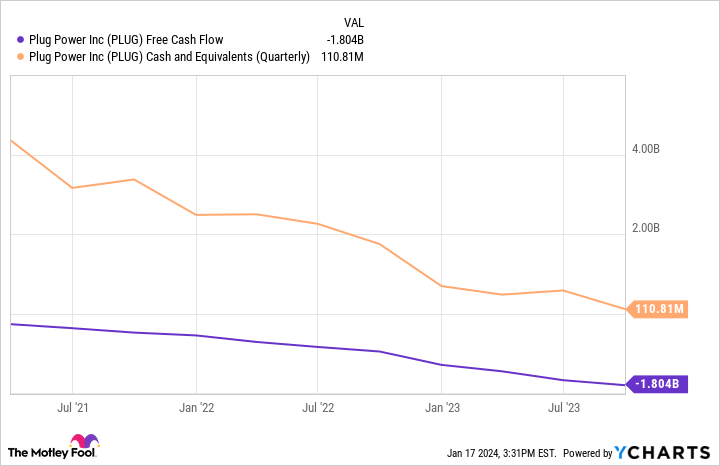

This has become a downward spiral for Plug Power that may not stop. You can see in the chart below that cash levels fall as a company's cash burn rate rises. Management has previously used company stock to fill the cash gap by selling stock, however With the stock price falling, this option may no longer be available.

There are potential billions of dollars in bookings and orders, but they could take years to fulfill, and the financial challenge is more pressing for Plug Power. The company even warned that it may not be a “going concern,” meaning it may not have the ability to finance the business on its own.

Free fall that may never stop

Plug Power has been through tough times before, but the challenge now is that it has $200 million in debt and the company is burning through more cash than ever before. Without the ability to raise more debt or sell stock, which becomes more difficult the lower the stock price falls, this stock may only head lower. This seems like a reason to dump the stock today, if you haven't already.

Should you invest $1,000 in Plug Power now?

Before you buy stock in Plug Power, consider the following:

the Motley Fool stock advisor The analyst team has just defined what they think it is Top 10 stocks Let investors buy it now… and Plug Power wasn't one of them. The 10 stocks that were discounted could deliver huge returns in the coming years.

Stock advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. the Stock advisor The service has more than tripled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Travis Huium He has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has Disclosure policy.

Why energy stocks fell another 13.5% today Originally published by The Motley Fool

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”