- Lido and Rocket Pool’s share tokens have been classified as securities by the Securities and Exchange Commission.

- The price of LDO fell on the charts, while the price of RPL remained relatively stable

The US Securities and Exchange Commission (SEC) is in the news again for all sorts of compelling reasons. This time, to classify the likes of Lido [LDO] And the pool of missiles [RPL] As securities.

The SEC Strikes Again

The SEC considers Lido and Rocket Pool’s staking programs to be securities because they operate similarly to investment contracts. Investors contribute ETH to a shared pool, with the expectation of earning profits based on the efforts of the program’s managers, rather than their own actions.

The SEC’s classification of Lido and Rocket Pool’s betting software as securities could have several negative consequences. Registration and compliance with securities regulations can be costly and time-consuming, and Lido and Rocket Pool could face significant hurdles in meeting these requirements.

The lawsuit has sparked fear in the market, which could lead to decreased user engagement and decreased value of their tokens (stETH & rETH).

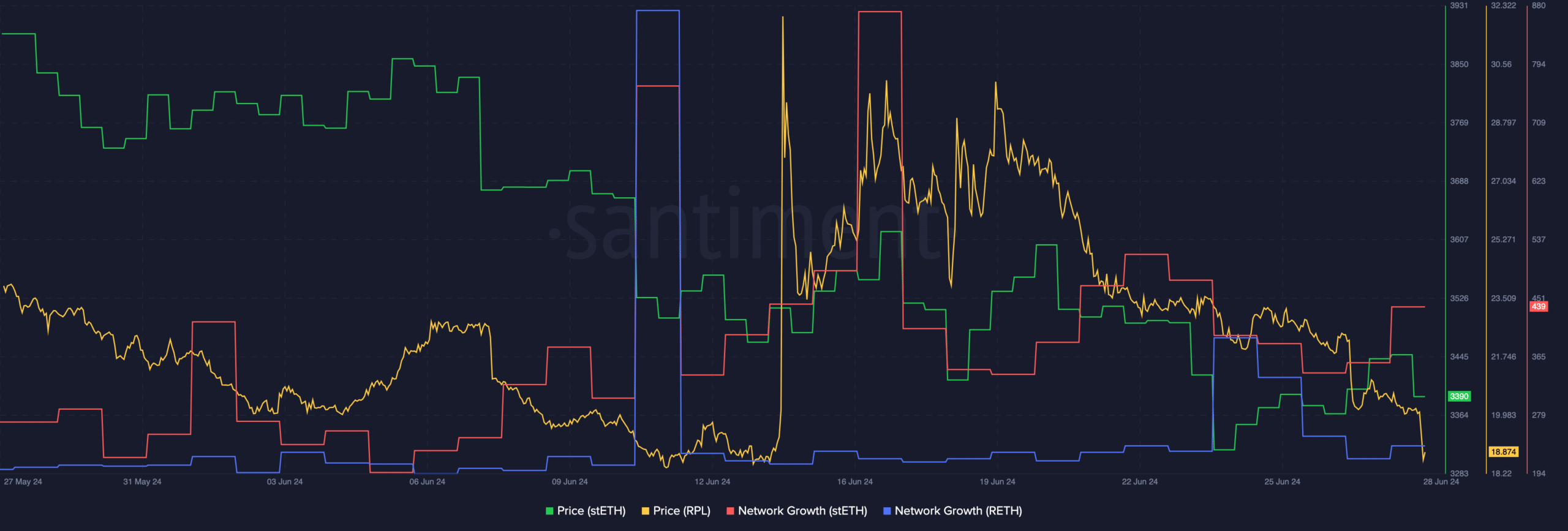

In fact, data from Santiment reveals that network growth associated with both stETH and rETH has dropped significantly over the past few weeks. This suggests that the number of new addresses interested in both tokens has dropped significantly.

If new users continue to lose interest, both protocols may suffer.

Source: Santiment

Additionally, acting as a security tool may restrict Lido and Rocket Pool’s ability to freely offer their services. They may face restrictions on who they can offer their services to or how they can organize their programs.

deja vu

The SEC’s lawsuit against Ripple Labs provides valuable insights into the potential consequences Lido and Rocket Pool may face. In this case, the lawsuit caused a significant drop in the price of XRP as exchanges delisted it due to uncertainty about its legal status. In fact, LDO and RPL have already recorded price declines following the SEC announcement. It is not unlikely that a further decline will occur.

At the time of writing, LDO stock is down 18.17% in the last 24 hours. On the other hand, RPL stock is down 1.08%.

Whether it’s real or not, here’s the market cap of LDO in terms of BTC

However, it is also important to see that the primary argument made by the SEC in the Ripple case was that XRP itself was a security sold through an unregistered offering.

The case of Lido and Rocket Pool is a little different. The SEC views its staking software as investment contracts, not the tokens themselves, which could mean bad news for stETH and rETH. Therefore, the impact on LDO and RPL will remain highly uncertain for some time.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”