Tesla (Tesla)Tesla, the leading electric car maker in the United States, has a clean energy business that could be the company’s secret growth engine in the next decade. Under this business segment (known as power generation and storage), Tesla sells energy storage products and solar power systems to customers, capitalizing on the growing demand for renewable energy products.

Since its founding in 2015, Tesla’s energy business has grown to a $3 billion business today, and the company is aggressively expanding into key global markets like China to gain long-term competitive advantages on a global scale. I am bullish on Tesla’s prospects because I believe the company is well positioned for growth over the next decade.

Energy sector boom

In the second quarter, Tesla’s energy storage deployments reached an all-time high of 9.4 gigawatt hours, up 158% year-over-year. On the back of record deployments, power generation and storage revenues reached a new high of $3 billion, compared to just $1.5 billion in the second quarter of 2023. Meanwhile, the core EV business saw revenues decline 7% in the second quarter, highlighting the importance of the energy business at a time when macroeconomic pressures are limiting growth in the EV sector.

The growth of the energy business is already helping Tesla’s bottom line. In the second quarter, the energy segment’s gross profit margin expanded more than 600 basis points year over year to 24.6%, while automotive gross profit margins fell 70 basis points to 18.5%. Even on an absolute basis, energy gross profit margins are well ahead of automotive, suggesting that energy is fundamentally more profitable than Tesla’s core EV business. The second quarter was the most profitable quarter for the energy business since its inception.

A year ago, the energy business contributed only about 6% of total earnings, but in the second quarter the contribution of this sector rose to 16.3%. This is an encouraging sign, given the high profitability of this business segment.

Tesla is investing heavily in its energy business to capitalize on the renewable energy opportunity. During its second-quarter earnings call, CEO Elon Musk claimed that the company plans to increase production in the United States. Additionally, Tesla is building a massive factory in China to meet the growing demand for energy storage systems. According to company executives, Tesla is on track to at least double its energy storage capacity in the foreseeable future.

The big picture is promising.

according to Bloomberg NEFThe global energy storage market is expected to triple in 2023, with 97 GWh of storage capacity added globally. Global energy storage additions this year are expected to reach 100 GWh, building on the positive momentum from last year. Bloomberg NEF The global energy storage market is expected to grow at a CAGR of 21% to reach 442 GWh by 2030. Continued adoption of renewable energy is at the heart of this forecast.

Energy storage systems play a critical role in supporting the transition from fossil fuels to renewable energy. They help balance the intermittent nature of renewable energy sources by helping consumers and energy producers store excess energy for use when production falls short of demand.

Analysts are betting big on the energy sector.

Wall Street remains concerned about Tesla’s growth prospects amid slowing global electric vehicle sales, but some experts are banking on the energy sector for huge returns. For example, Nancy Tingler, CEO and CIO of Laffer Tingler Investments, believes the energy sector will drive strong earnings growth for Tesla in the coming years. She even compared the energy sector to Amazon Web Services, which has been a major driver of Amazon’s profits. (MZN) In the last years.

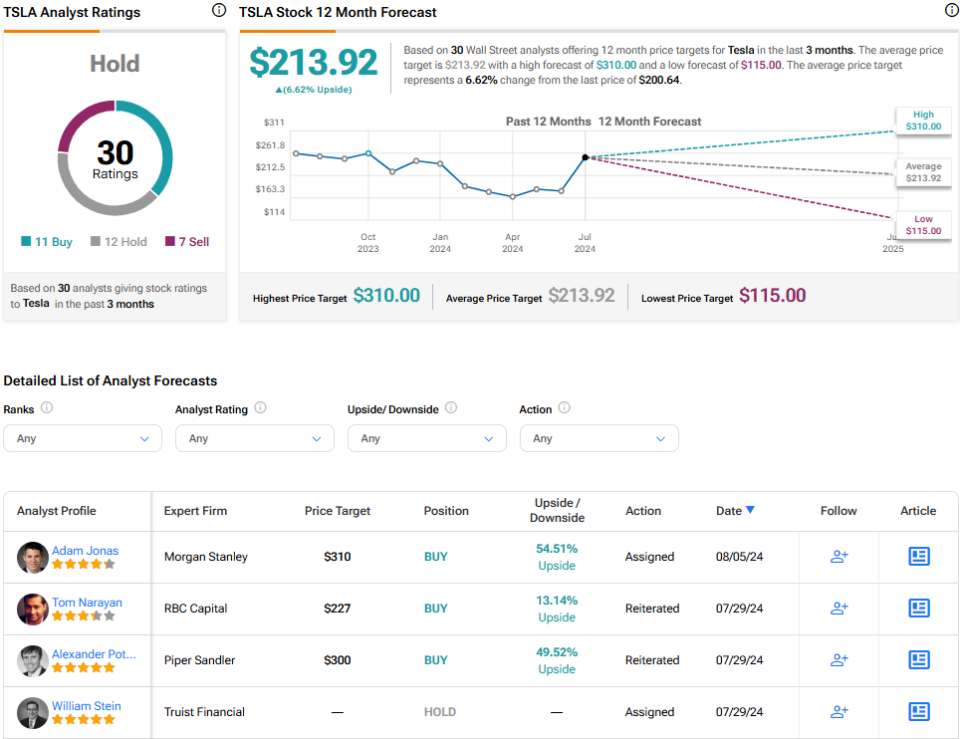

In addition, Morgan Stanley (Ms) Analyst Adam Jonas, after digesting second-quarter earnings, Tesla price target raised to $310The analyst put the energy sector at $50 per share, up from his previous estimate of $36 per share. After raising his estimate, the analyst commented that the energy sector is “stealing the show.”

Cantor Fitzgerald analysts also raised their full-year revenue estimates for Tesla on the back of improved expectations for the energy segment. Cantor analysts now expect energy storage deployment of 29 gigawatt hours in 2024, significantly higher than the previous estimate of 16.3 gigawatt hours. Energy segment revenue is expected to reach $9.6 billion this year versus the previous forecast of $6.6 billion. Stifel and Baird analysts also commented positively on Tesla’s energy business outlook after a strong second-quarter performance.

Is Tesla Stock a Buy According to Analysts?

Tesla’s stock has fallen more than 16% this year amid electric vehicle price cuts, intensifying competition, rising interest rates, inflationary pressures and regulatory challenges. This weak market performance has made Tesla’s valuation more reasonable. However, based on the assessments of 30 Wall Street analysts, Tesla’s stock has a consensus rating of Hold. Tesla average target stock price The stock price is now $213.92, which means a potential upside of 6.6% from the current market price.

See more analyst reviews for TSLA

Based on analysts’ expectations, Tesla’s value today seems fair. Tesla has always enjoyed excellent valuation multiples because of the company’s long road to growth. Today, at 83x forward P/E, Tesla is trading well below its five-year average multiple of nearly 300x. While Tesla may not be as cheap as traditional automakers, the growth of its energy business, Tesla’s dominance in the U.S. electric vehicle market, and the company’s expansion into robotaxi justify its valuation today.

Bottom line: Tesla still has a lot to offer.

Tesla’s energy business has proven to be a growth driver at a time when the company’s core electric vehicle business is facing challenges. In the long run, both of these businesses will contribute positively to growth, which justifies the company’s premium valuation today. Analysts have also become bullish on the energy business’s prospects, which should lead to a significant increase in earnings estimates.

This is good news for Tesla, as positive earnings reviews often lead to momentum in the stock market. Despite the short-term challenges, Tesla appears well-positioned for growth.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”