-

Nvidia’s first-quarter earnings results this week could move the entire stock market.

-

Its high revenues and profits have driven the bulk of the S&P 500’s earnings growth over the past year.

-

Bank of America shared how investors can hedge against the risk of Nvidia’s earnings impacting the broader market.

All eyes on Nvidia This week as the company prepares to report first-quarter results after the closing bell on Wednesday.

The chipmaker’s earnings report could trigger a big move in the stock market, either to the upside or to the downside, depending on how the results turn out.

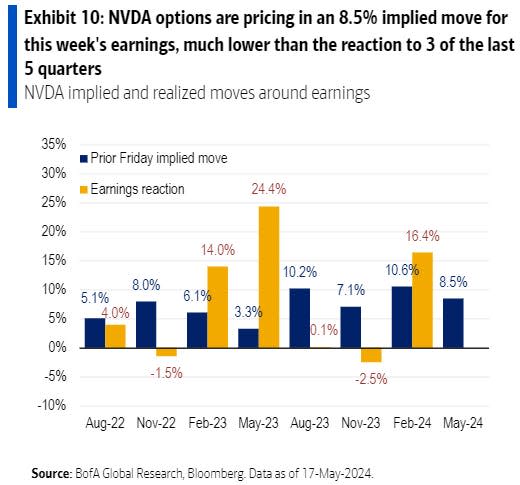

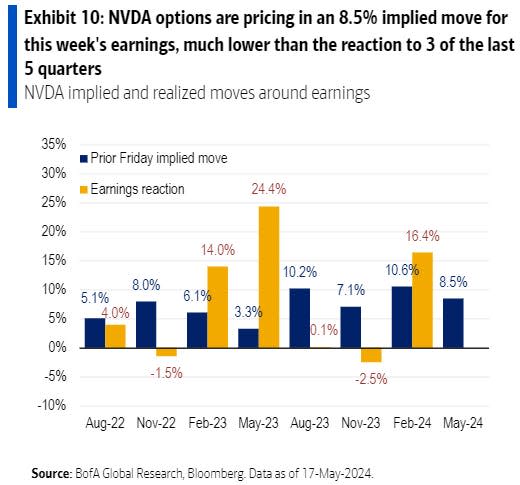

Current options pricing suggests that Nvidia will jump or fall 8.5% following its earnings results, which is significantly lower than previous Nvidia earnings releases when options traders were pointing to a 14%-26% move.

That’s because Nvidia and its successful lineup of AI-focused GPUs have had a massive impact on the earnings growth of the S&P 500. Over the past 12 months, Nvidia’s earnings growth has driven 37% of the company’s total earnings. Standard & Poor’s 500 Earnings per share growth. But over the next 12 months, Nvidia’s earnings growth is expected to drive only 9% of the S&P 500’s earnings growth.

This dynamic highlights the potentially market-shaking impact Nvidia could have on the broader stock market this week American bank He has a way to hedge against risks.

Instead of buying call or put options on major indices like the S&P 500 and S&P 500 Nasdaq 100Bank of America recommends investors buy shares or put options on Nvidia itself.

In other words, if an investor believes that the stock market will fall this week based on Nvidia’s earnings results, instead of buying put options on the S&P 500 or Nasdaq 100, they should buy put options on Nvidia, and vice versa with call options if they believe that The stock market will rise.

“For those concerned about the impact (positive or negative) of NVDA’s earnings on the broader market, NVDA options offer better value than hedging with indexes like QQQ, SPY, and SMH (Semis ETF),” Bank of America said.

The reason is that Nvidia options cost less than options on broader indices, according to the bank, likely due to strong liquidity and trading interest in the AI giant.

“Don’t mess with dealers; hedge with NVDA options,” Bank of America said.

Read the original article on Interested in trade

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”