The Case-Shiller Index, which is 4-6 months behind on the ground, is beginning to pick up price dips in Seattle, San Francisco, San Diego, Los Angeles, Denver and Portland.

by Wolf Richter for Wolf Street.

The housing market is undergoing some brisk staring, as many buyers have evaded current prices and mortgage rates. They’re still there, but they Many Less than that, and many sellers haven’t figured it out yet, although some have started cutting their order prices but not nearly enough, and the volume of deals has gone down.

Existing home sales are down 20% from last year across the USby 31% in California, 41% in San Diego. Average prices in the West began to fall, and in The San Francisco Bay Area has fallen below last year’s levels, including 8% in San Francisco. . sales the new Homes fell nearly 30% year on year across the US, and in the West by 50%, with the supply of new homes increasing to 11 months, Highest since the height of the residential bust 1. And the Large institutional buyers began to withdraw from this market Because they don’t want to overpay. This has been happening for months.

but today S&P CoreLogic Case-Shiller Home Price Indexwhich lags reality on the ground by 4-6 months, has finally picked up its first month-to-month price drops — all in the West: metros in Seattle, San Francisco, San Diego, Los Angeles, Denver and Portland.

The Case-Shiller Index was released today for the month of June, which consists of the three-month average of closed-home sales that were entered into public records In April, May and June of deals done a few weeks ago to two months ago, roughly in March through May.

By mid-April, the average 30-year fixed-rate mortgage had breached the 5% mark and has remained above 5% ever since. Well let’s go.

The most amazing housing bubbles where prices have fallen.

Home prices in the Seattle metro fell 1.9% In June (three-month moving average for April, May and June) from May, which in one month wiped out the gains of the previous two months as well as some of the gains. This was the first monthly decline since October 2019, after a completely ridiculous rise. It cut the year-over-year rise to 9.3%, from 27% a few months ago.

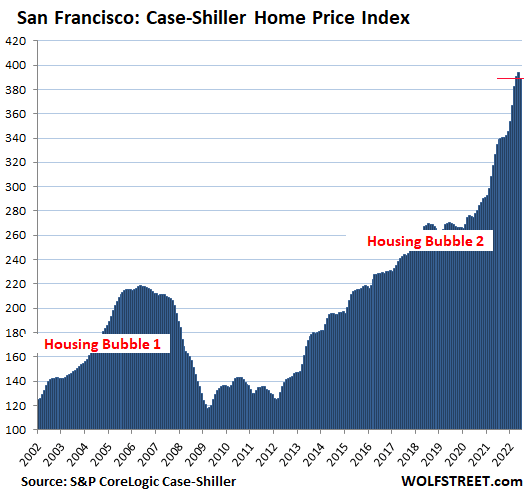

San Francisco Bay Area home prices fell 1.3% In June of May, below the April level, and the first monthly decline since June 2020, which in one month erased the gains of the previous two months. This pared the year-over-year rise to 16.1%, from more than 24% in previous months.

For the Case-Shiller Index, the metro is made up of the five counties that cover San Francisco, part Silicon Valley, part East Bay, and part North Bay.

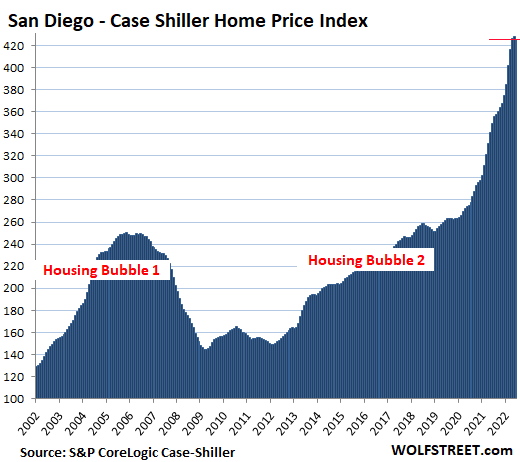

San Diego metro house prices fell 0.7% In “June”, the first monthly decline since October 2019, after a ridiculous rise. The index fell below the April level, erasing in one month more than two months of gains.

That 0.7% pullback cut year-over-year gains to 21.6%, from nearly 30% gains a few months ago.

The value of the index 425 for San Diego means that home prices have risen 325% since January 2000, when the index was set at 100, despite the decline in the middle (CPI inflation was 75% during the same period).

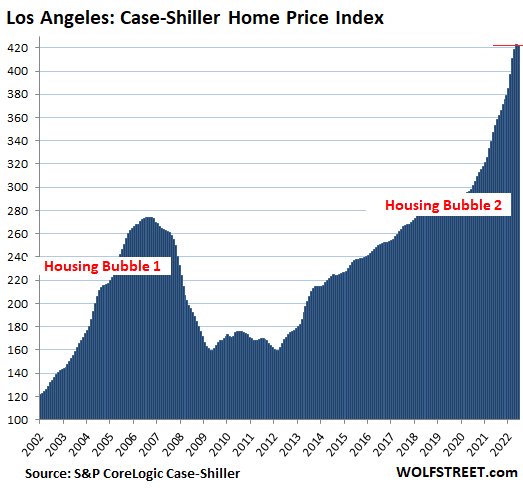

Los Angeles metro house prices fell 0.4% In June from May, reducing the year-on-year price hike to +19.4%.

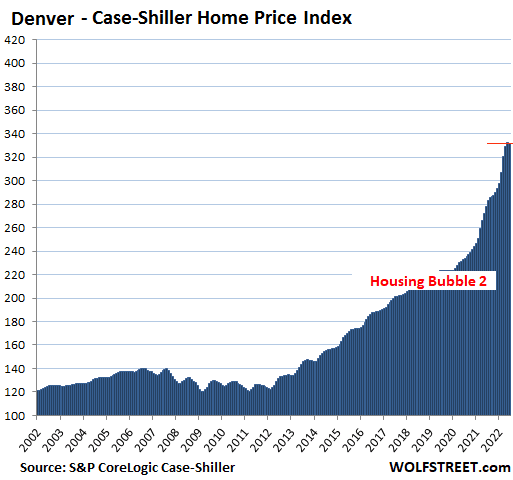

Denver metro house prices down 0.1% In June from May, with annual gains reduced to 19.3%:

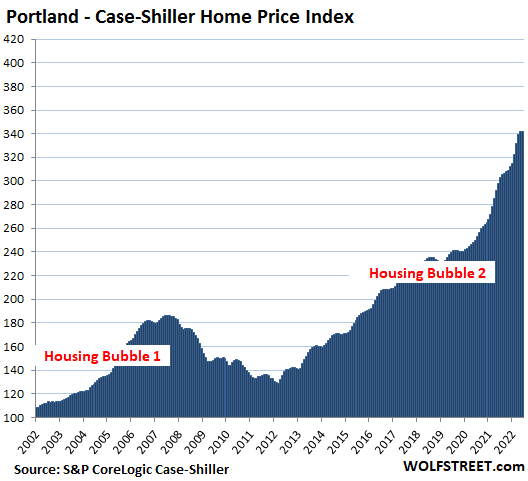

Home prices in Portland metro fell 0.1% in June from May, which trimmed its year-over-year gain to 14.7%. The month-to-month drop, the first since October 2019, is too small to be identified in a 20-year chart:

Home price inflation. The Case-Shiller indicator uses the “sales pairs” method. Sales in the current month are compared to the same homes that were sold previously. Price changes within each sales pair are incorporated into the metro index, and adjustments are made for home improvement (methodology). In other words, the indicator tracks the change in dollars it took to buy same home over time, making it a measure of home price inflation.

The coolest housing bubbles where prices have “slowed down” or stopped.

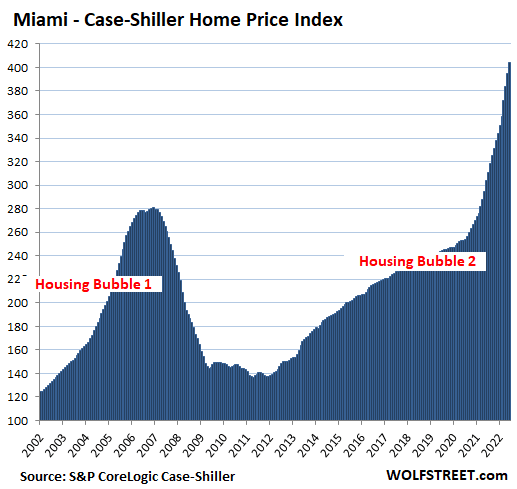

Miami Metro: +2.3% for the month, “slowing down” from monthly gains in the 3.5% range in previous months. This cut annual gains to +33% from +34% in the previous month, ridiculously crazy, all of that.

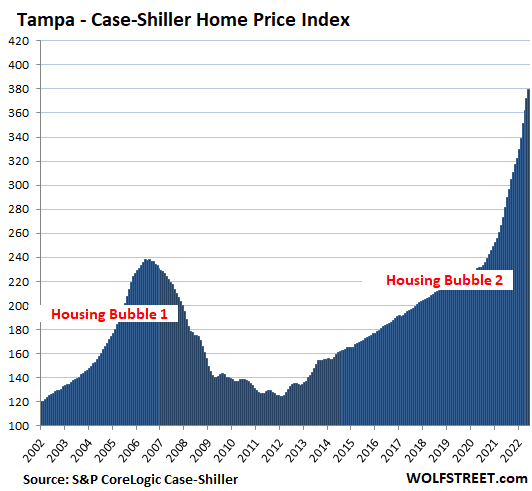

Metro Tampa: + 2.2% for the month, slowing from 3.7% earlier this year. This reduced the annual rise to 35.0% from 36% in the previous month. crazy mind.

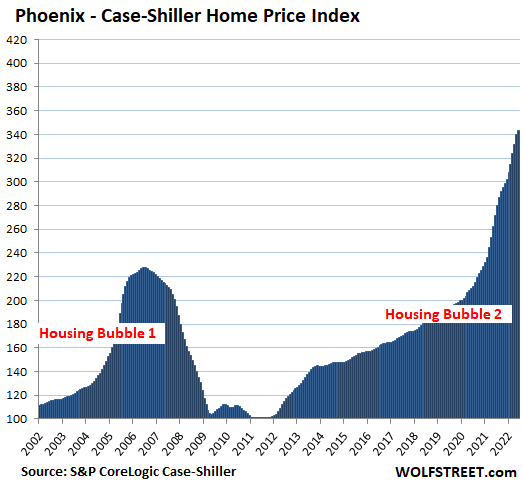

Metro Phoenix: +1.0% for the month, slowing from +2.5% in April, and from +3.0% earlier in the year. This cut the year-over-year rally to +26.6% from +32% earlier this year:

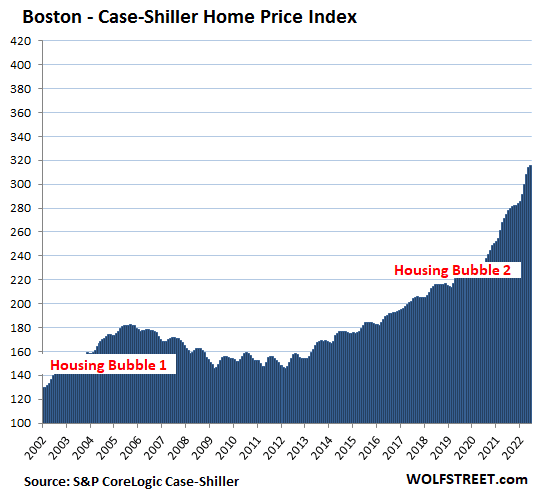

Boston metro: +0.6% for the month, slowing from 1.9% the previous month, and from +2.8% earlier this year. This reduced the annual gain to 14.9%:

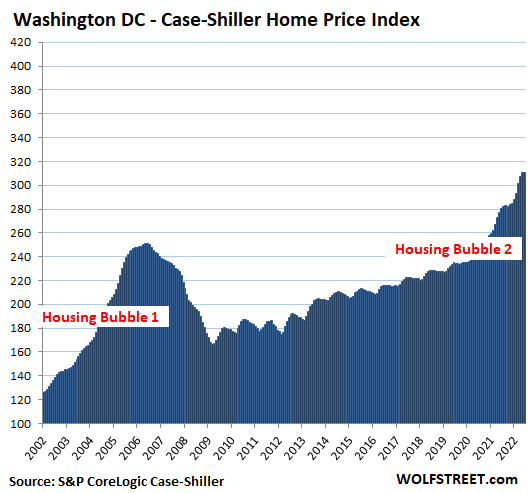

Washington DC metro: +0.0% for the month, no change, slowing from 2.9% earlier this year. This reduced the annual gain to +10.8%:

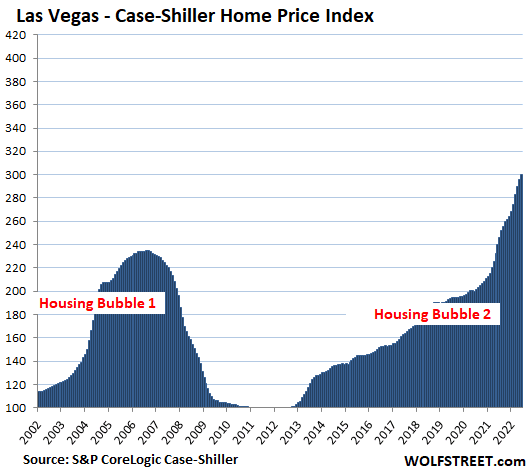

Las Vegas metro: +1.5% for the month, slowing from +2.1% from the previous month, and from more than +3% earlier this year. This reduced the annual gain to +25.1%:

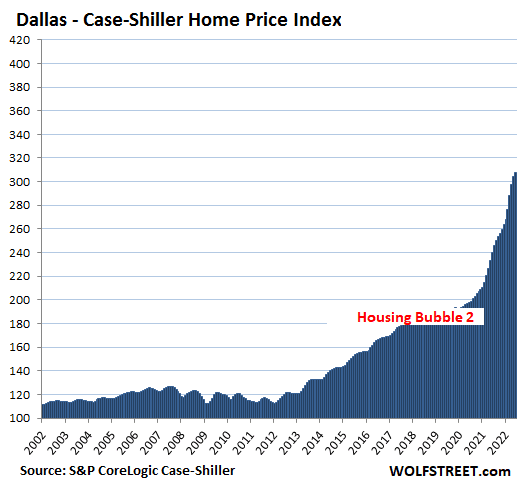

Dallas Metro: +2.6% for the month, as in the previous month, but slowed from more than +4% earlier this year. Annual gains remained at +30.8%:

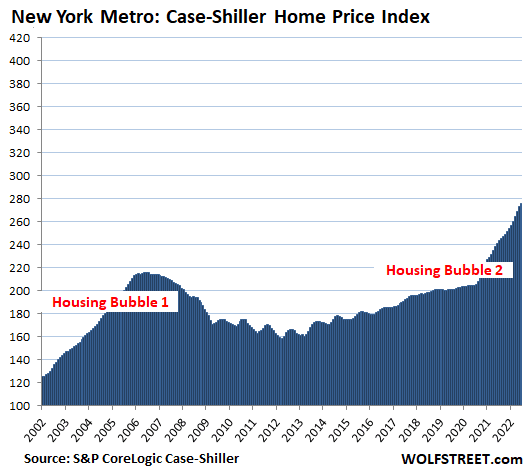

new york metro, Massive market within commuting distance to New York City: +1.1% for the month, slowing from 1.6% in the previous month. Annual gains +14.6% are virtually unchanged for three months.

With its index value of 276, New York Metro has seen 176% home price inflation since January 2000. The remaining 20 Case-Shiller cities (Chicago, Charlotte, Minneapolis, Atlanta, Detroit, and Cleveland) have experienced lower home price inflation and do not qualify for this brilliant list.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a glass of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”