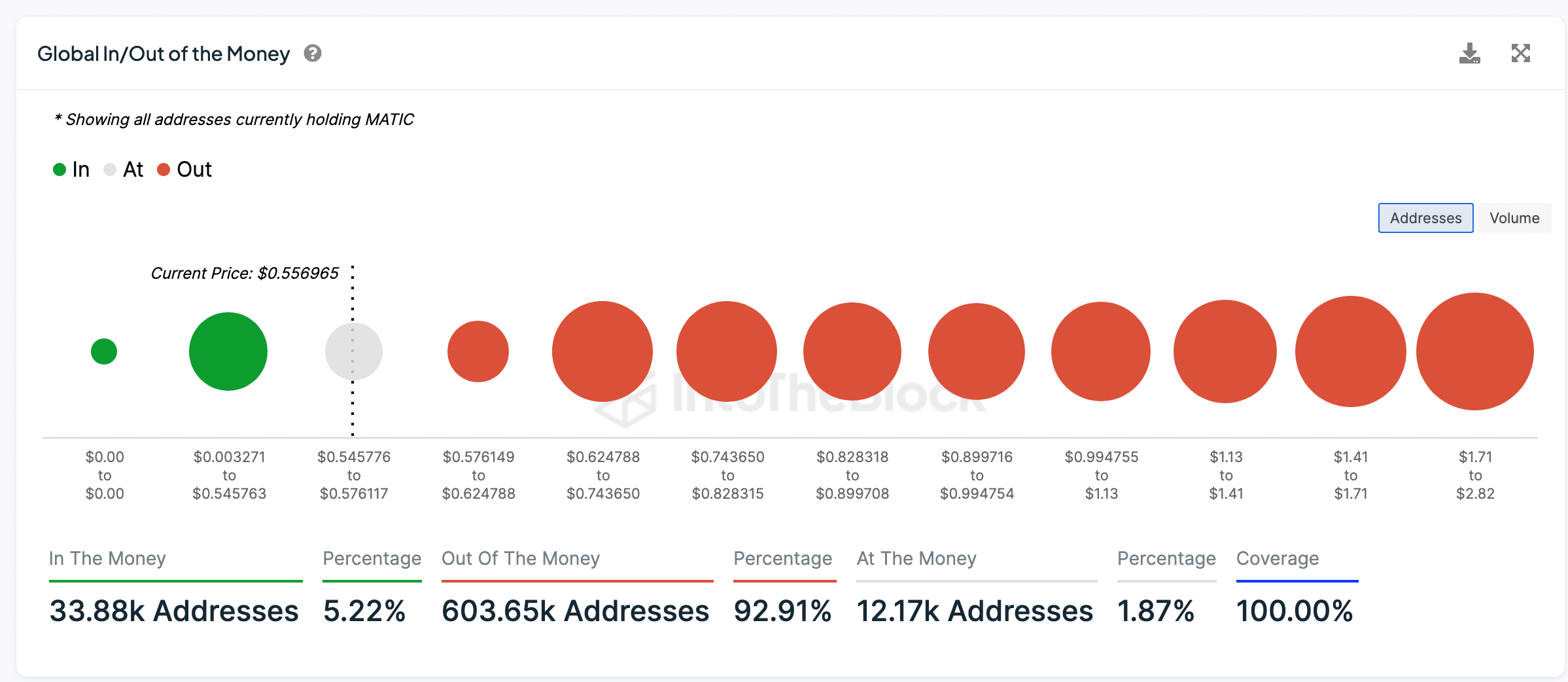

- Most MATIC titles are “out of money”.

- Decreasing whale trades could reduce short-term volatility and support a bullish reversal.

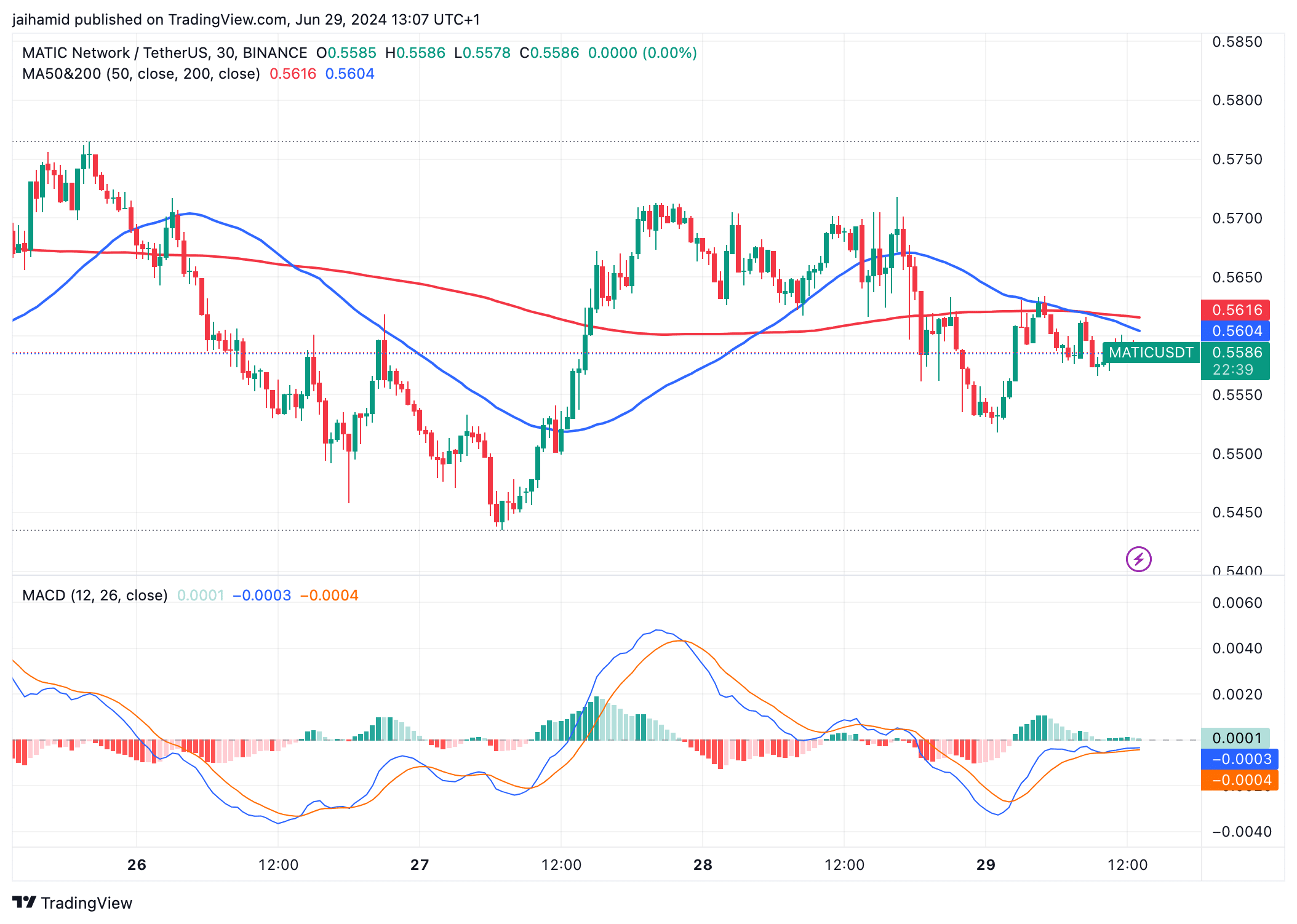

Polygon’s native token, MATIC, was in the news today after hitting a nine-month low on the charts. As expected, this raised some concerns among investors and traders alike. However, despite the bearish sentiment mentioned, the Moving Average Convergence Divergence (MACD) indicator seems to be indicating that a bullish reversal could be near.

At the time of writing, the MACD line is hovering just below the signal line, indicating bearish momentum on the charts. However, the proximity of the two lines means that a bullish crossover may also be imminent.

Source: TradingView

Meanwhile, MATIC price was below the 50 and 200 period moving averages as well – a sign of a short-term downtrend.

Together, this consolidation around press time price levels, coupled with a bullish MACD crossover, tells us that buyers may be slowly gaining strength. This could be key to renewing bullish strength in the altcoin market.

Bears in the market are still there

The majority (92.91%) of MATIC addresses are currently “out of the money,” meaning their holdings are now worth less than the purchase price. Conversely, only a small portion (5.22%) are “in the money.”

Source: IntoTheBlock

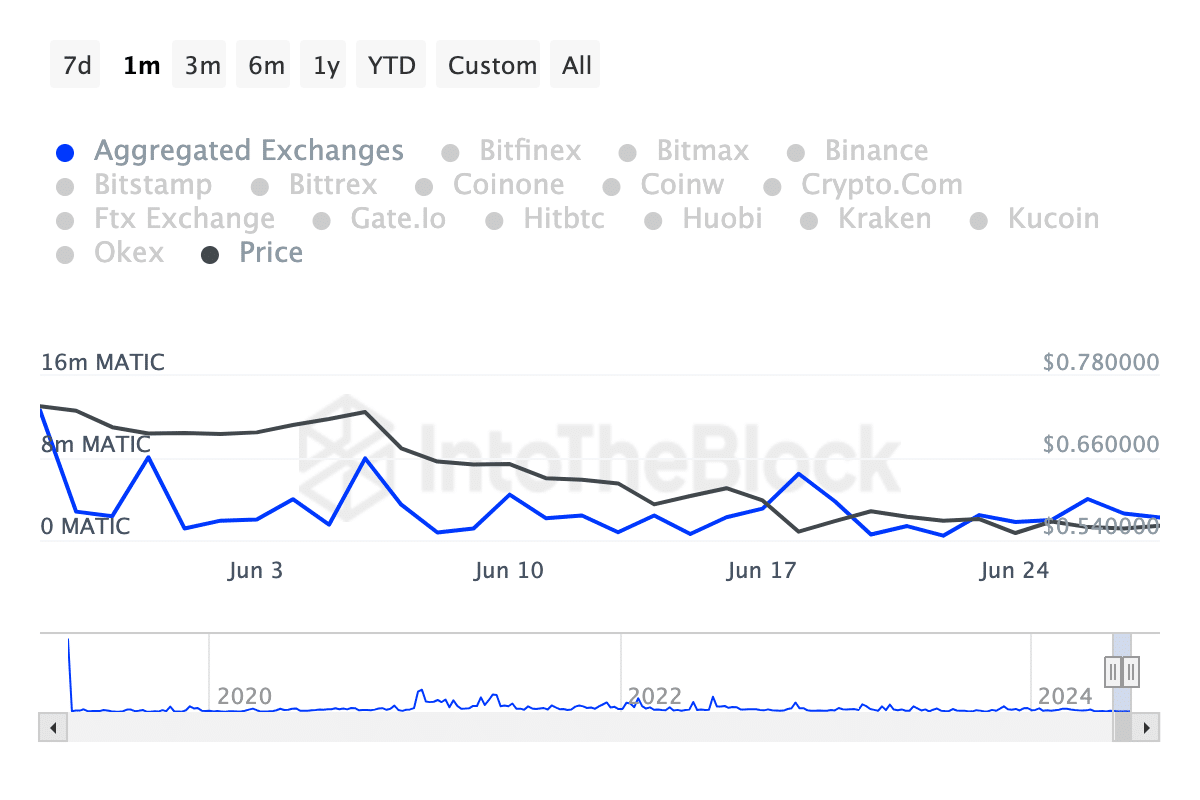

Exchange flow volumes have also seen significant increases – typically a sign of selling pressure as investors move their tokens to exchanges, possibly to sell them.

However, recent MATIC patterns appear to be showing a stable to decreasing trend in inflows. This means that immediate selling pressures may be easing on the charts.

Source: IntoTheBlock

However, the data also indicated that outflows have been fairly steady. Simply put, selling pressure has not increased by a significant margin recently.

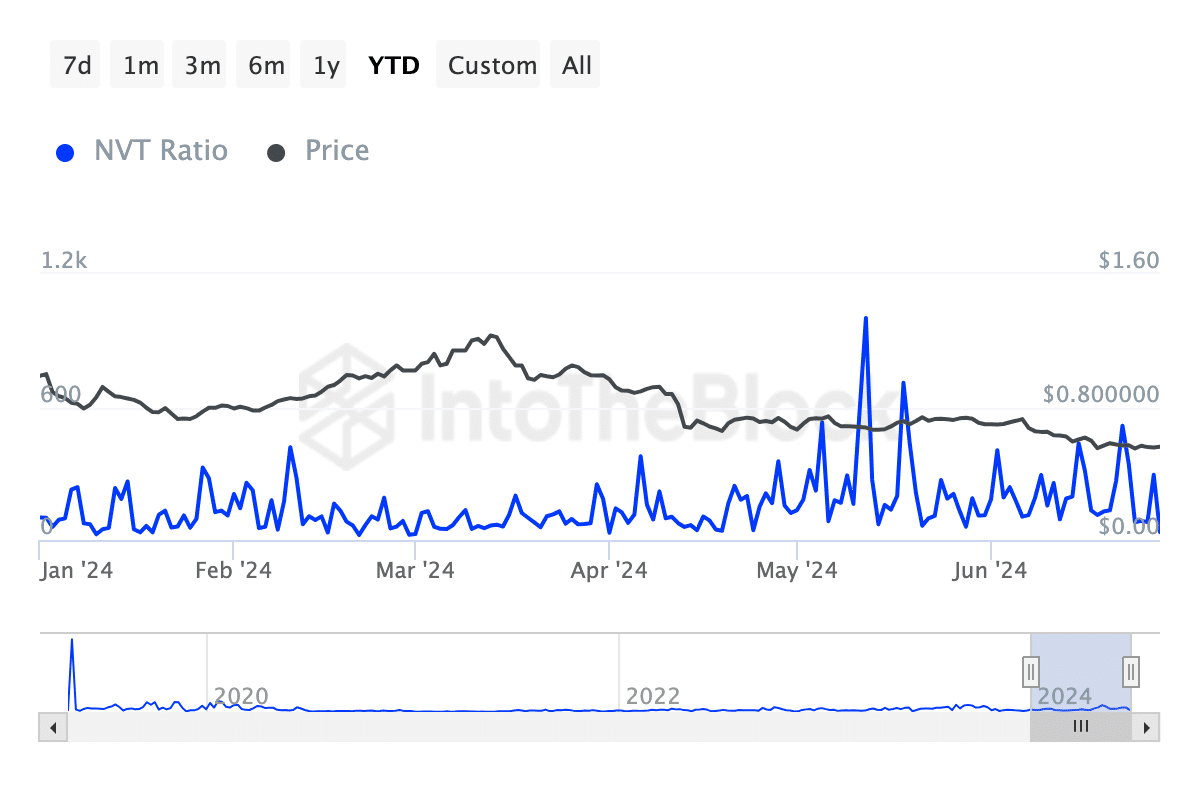

The net worth ratio has seen some fluctuations, but has been trending down on the charts. This means that there is either an increase in transaction volume or a decrease in network value. This could be viewed as a bullish sign if increases in transaction volume are sustainable.

Source: IntoTheBlock

Finally, there appears to be a downward trend in whale transactions, which indicates a decrease in the activity of large investors and a decrease in speculative trading with large volumes. This will reduce short-term volatility.

For a bullish reversal to gain traction, market sentiment needs a massive bullish catalyst that is either grid-related or related to broader economic trends.

“Infuriatingly humble alcohol fanatic. Unapologetic beer practitioner. Analyst.”